by First Union Lending | Dec 19, 2022 | Business Finance, Business Strategy, Resources, Small Business

Different from a personal credit score, your business credit score is focused precisely on your business. This means it takes into account your timelines as far as payments to creditors and suppliers. Have you missed payments? Is everything up to date? Additionally, a...

by First Union Lending | Dec 5, 2022 | Business Finance, Resources, Small Business

What sets apart successful business owners from those who struggle to keep their companies afloat when difficulties arise? Having a positive attitude and superior problem-solving skills are two common traits shared by great entrepreneurs.Below, we’ve listed...

by First Union Lending | Aug 12, 2022 | Business Finance

Unfortunately, PPP loans are no longer available for small businesses. But that doesn’t mean you’re completely out of luck. While the PPP loan program was undoubtedly a boon to small companies during a very difficult time, it’s not the only option that you have...

by First Union Lending | Aug 5, 2022 | Business Finance

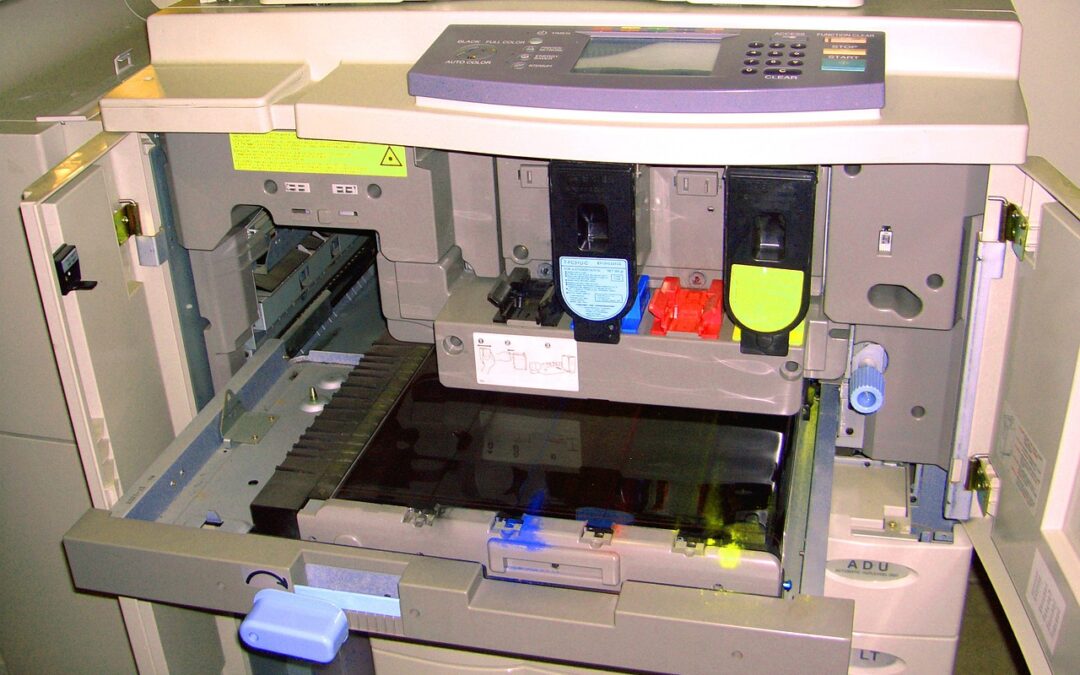

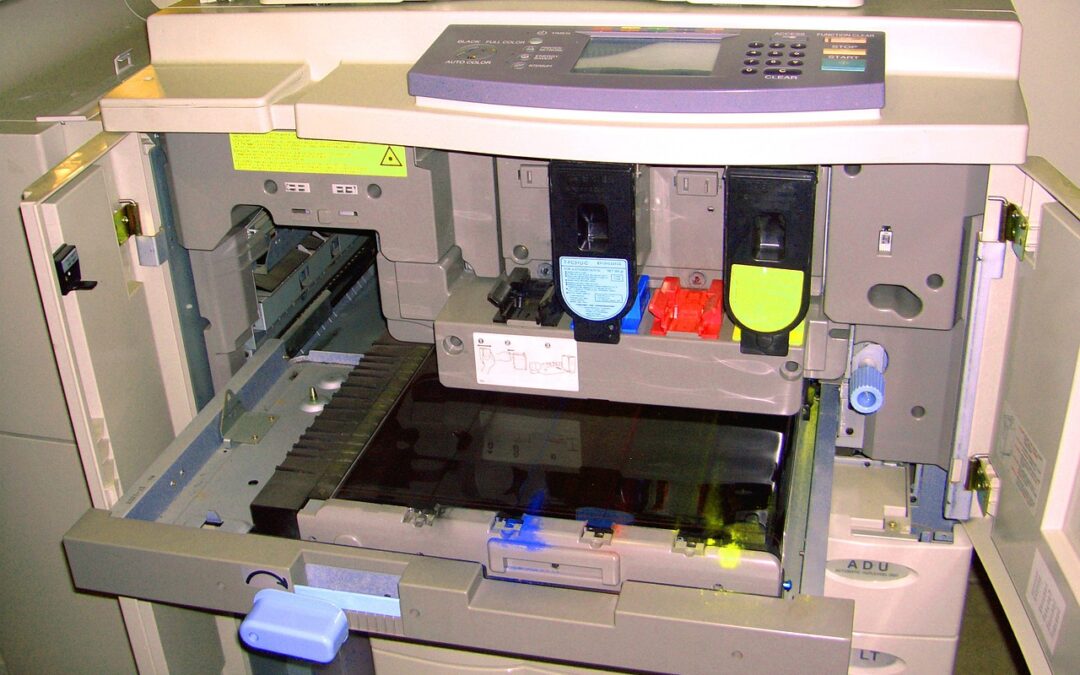

As a small business owner, you likely understand the need for getting cash quickly. There are emergencies that arise, there’s inventory that needs to be paid for, a new roof might need to be put on your building, or, you may need to purchase new equipment. Equipment...

by First Union Lending | Jul 26, 2022 | Business Finance

For some companies looking to get a business loan, it can be confusing trying to figure out where to start. You probably also have numerous questions regarding the loan process. Business loans aren’t as difficult to get as some people think. It’s about being prepared,...

by First Union Lending | Jul 19, 2022 | Business Finance

In the past few months, interest rates have been keeping people on their toes. Business loan interest rates are among them. During their June meeting, the Federal Reserve raised short-term interest rates by 3/4 of a point. This marks the largest increase since the...