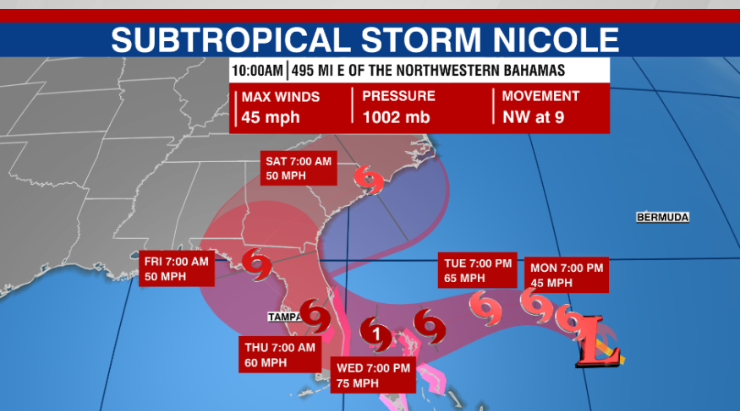

As we are currently monitoring Subtropical Storm Nicole, which is expected to strengthen into a hurricane before landfall on Florida’s east coast, we wanted to ensure you and your small business are ready for instances like this.

Hurricane Preparedness

Like your home hurricane preparedness plan, prepare for the unexpected and put your employees first during this time. Here are some preparation suggestions you should include in your business’s plan for dealing with natural disasters:

Send Non-Essential Employees (If not all) Home:

The safety of your employees should be your priority. Do not wait until the last minute to send your employees home. Give them enough time to get to safety or evacuate if needed. Prepare a list of your employees and their contact information so you can keep in touch in emergencies. If your business is considered essential and you need staff on hand in case of emergencies, provide these employees with a chain of command and a list of responsibilities in the event a disaster strikes.

Keep Your Clients Informed

If you are within the cone of a Hurricane, there may be a chance your facility may shut down to preserve the safety of your employees and inventory. In that instance, be sure you are keeping your clients informed about the status of your business during the storm. If you need to shut down for a day or two, inform clients via social media, blog posts, or webpage banner informing them of the times, you will be closed and when the business will resume as normal.

Communicate With Your Vendors

If you rely heavily on vendors to provide your inventory, be sure you’re in communication so you can order more items needed for your business. Post-Hurricane cleanup can take some time and delay business operations. If you plan and order more than you need – your business may be in a secure position to resume operations as a community cleanup takes place.

Prepare Your Business Location

Consider installing impact-resistant film or wooden boards on your windows before the hurricane lands. Fill sandbags if needed, and be aware of local flood maps to be sure you’re in a safe location. Have your building inspected by a professional to ensure the roof and other parts of the building comply with the wind loading requirements of your area. If you have items outside, bring them inside or tie them down to prevent items from flying away. Minimize the amount of property damage as much as you can.

Gathering Supplies

If you’re an essential business that needs to remain open during natural disasters, consider stocking up on the following items. Be prepared for the unexpected.

- Flashlights and extra batteries

- Battery-powered radios

- Blankets

- Paper plates, cups, and utensils

- Manual can openers

- Hand sanitizers and anti-bacterial wipes

- Ready-to-eat canned foods

- Drinkable water

- First Aid Supplies – bandages, sterile dressings, gauze pads, cold packs, scissors, tweezers, etc.

Post-Hurricane Actions

Things can happen at a moment’s notice, even after the hurricane has passed through your area. Be sure to continue monitoring the hurricane and be aware of warnings such as flash floods or mandatory curfews from the local authorities.

Reach out to all your employees to be sure everyone is safe, if they need help, or if they are in a position to help out other employees. Once you have your employees accounted for, you can plan to restart business operations. Offer support to all your employees if they need more assistance outside of immediate disaster relief.

Check on your business to ensure the building is safe for normal business operations. Suppose your business has been impacted by a natural disaster like a tropical storm or hurricane. In that case, an EIDL loan may help cover expenses needed to continue normal business operations.

If you do not qualify for an EIDL loan, do not worry. First Union Lending also offers various EIDL Loan Alternatives to help your business in a time of need.

First Union Lending is Here to Support You

First Union Lending offers numerous financing programs designed with small businesses in mind. Our business loans are fast and flexible, with financing options ranging from $5,000 to 2 million dollars. Call today to learn more about our various financing solutions to help your business grow and become successful.