What could your Atlanta-based business do with a small business loan? From expanding their office location to introducing a new product, business owners find valuable ways to put loan funds to work for them. Atlanta is all about creativity, innovation, and figuring out new ways to engage people. After all, the Georgia capital is home to almost half a million residents. How will you capitalize on this vibrant urban environment and dynamic cultural scene to propel your small Atlanta business forward?

Things to See and Do in Atlanta

Why do so many people relocate to Atlanta? This is because Atlanta truly offers locals and visitors plenty of things to do and see on any given day. In fact, in 2021, the city saw a 5% increase in its population. And it was recently ranked as one of the best places to live in the US.

There is the Martin Luther King Jr. National Historical Park. Or how about spending a day hiking and exploring the Atlanta BeltLine. You could also plan a visit to Centennial Olympic Park, home of the 1996 Olympic Games.

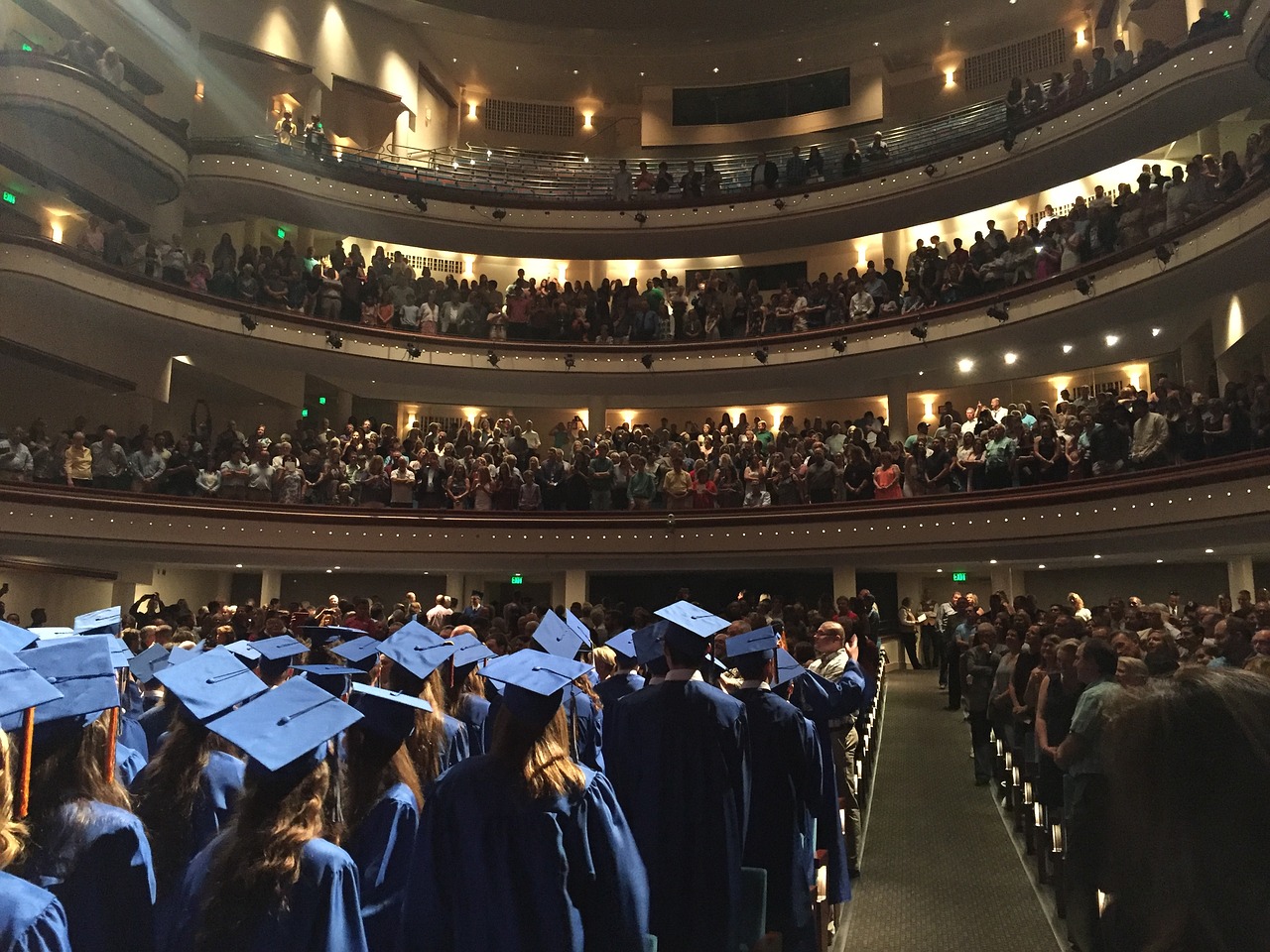

Not only is there plenty by way of attractions, art, and culture in this southern mecca, but Atlanta is also a notable college town. Emory University, Georgia State, and Morehouse College are among some of the top institutions based in Atlanta.

Why Start a Small Business in Atlanta

If you are thinking about starting a small business this year, there really could not be a better place to do so than Atlanta. Among the top reasons entrepreneurs flock here:

• Diversity. This city is incredibly diverse. Forbes has listed Atlanta as one of the top ten cities for black-owned businesses. Not to mention, the number of Latinx small business owners is steadily growing.

• Cost of doing business. Versus some other major metro cities on the east coast, Atlanta stands as one of the most affordable for small businesses.

• Start-up friendly. Atlanta is one of the most welcoming to newer companies for those looking to launch their business endeavors. Some deem Atlanta among the premiere start-up-friendly cities in the country.

• Deep talent pool. The talent pool here runs deep because the city is home to some top-tier colleges. Especially when labor shortages are the norm, having access to new graduates and young professionals is a bonus.

Getting a Small Business Loan in Atlanta

So what do you need to know about applying for a loan for your small business? Alternative and online lenders are changing the game regarding how the business loan process works. The great thing about commercial lending is the flexibility inherent in the process. Whether you’re based in Atlanta, Orlando, or New York City, you can work with a lender from pretty much anywhere in the country to get the funds you need.

One of the first things you want to do before applying for a loan is to work with the right lender. Not all lending companies are created equal. Do some research. See what the various organizations offer. And make sure they have a loan program that will fit your specific needs.

The more streamlined you make the process for the lender, the faster you will receive the funds you need. Also, be sure all documentation is up to date and ready to go. Among some of the key documents you may be asked to provide:

• Tax returns (business and personal)

• Financial statements to include balance sheets and cash flow statements

• Any lease agreements

• Licenses and permits

• A business plan

While a business plan isn’t always required, it is always a good idea. This shows a lender that you are serious about your goals and, consequently, the firm’s future.

You also want to spend some time thinking about what you plan to do with the loan proceeds. One of the biggest mistakes small Atlanta-based businesses make is to use the money without proper forethought. So, whether you plan to hire more staff or maybe launch a new marketing campaign or allocate the money for a rainy day when sales are slower, make sure to have a plan in place. This is your chance to make additional capital work for you in a meaningful and productive way.

First Union Lending Works With Businesses In Atlanta

Our Atlanta clients are thriving and this is exactly what we want to see. Our goal is to get you the funds you need in a timely manner so that you can propel your business forward. We offer short-term loans, lines of credit and SBA loans among other such products. Call today and let’s get started together!